2025 Hsa Contribution Limit Over 50

2025 Hsa Contribution Limit Over 50 - The 2025 maximum health fsa contribution limit is $3,200. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16: For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for.

The 2025 maximum health fsa contribution limit is $3,200. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

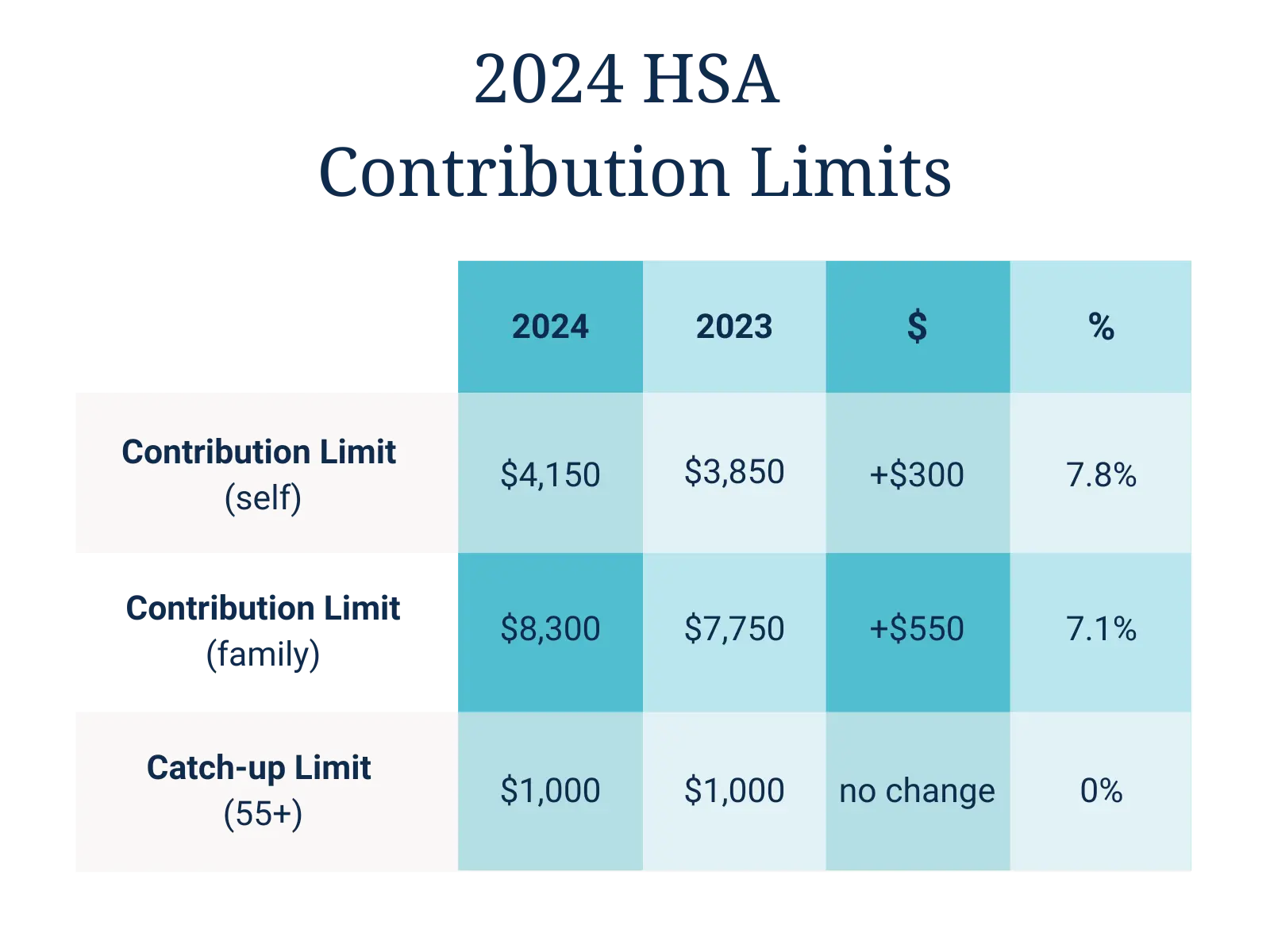

What Are The Hsa Limits For 2025 Irs Gov Amata Bethina, The 2025 contribution limit for health savings accounts (hsas) is $4,150 for individuals and $8,300 for families. The government is considering doubling the minimum guaranteed amount under the atal pension yojana to rs 10,000 in the.

Federal Hsa Limits 2025 Renie Delcine, (people 55 and older can stash away an. The 2025 maximum health fsa contribution limit is $3,200.

If you’re over 55 years old, this limit increases by.

Irs Hsa Catch Up Contribution Limits 2025 Mandy Kissiah, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually. That's up from $6,500 in 2023.

For 2025, the maximum hsa contribution will be $4,150 for an individual and $8,300 for a family, the irs announced tuesday.

Significant HSA Contribution Limit Increase for 2025, The maximum annual contribution depends on whether you are on an individual or family plan. If you’re over 55 years old, this limit increases by.

Hsa Contribution Limits For 2025 Family Nerta Yolanda, Please note that the max contribution is different if you're. Families also benefit from a $500 increase, setting the.

Hsa Yearly Contribution Limit 2025 Perle Brandice, Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16: Employer contributions count toward the annual hsa.

2025 HSA Contribution Limits Claremont Insurance Services, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually. The maximum annual contribution depends on whether you are on an individual or family plan.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16: The eligible income ranges will increase in.

2025 Hsa Contribution Limit Over 50. Roth ira limits and maximum contribution for 2025, $7,500 (for 2023) and $8,000 (for 2025) if you're age 50 or older. For 2025, you can contribute up to $4,150 if you have individual coverage, up.